delayed draw term loan commitment fee

The fee amount accumulates on the portion of the undrawn loan until the loan is either fully used. What is a ticking fee on a delayed draw term loan.

Priming Facility Credit Agreement Dated As Of December 28 Gtt Communications Inc Business Contracts Justia

DDTLs provide enhanced flexibility for longer-term capital.

. If you take out a DDTL youll be responsible for a ticking fee. A ticking fee accumulates on the portion of the undrawn loan until you either use the loan entirely terminate. While the fee structure for DDTLs has always been a negotiated point and has varied based on the actual arrangements sponsorsborrowers and debt providers the migration of the DDTL.

Like revolvers they have commitment fees around 1 and in addition they carry. Unlike a traditional term loan that is provided in a. How are delayed draw term loans structured.

The way a delayed draw loan works is that the lender and borrower agree to whats called a ticking fee representing a fee the. That is the fees are. Delayed Draw Term Commitment Fee.

TAxATION OF DELAYED DrAW TErM LOANS loan market might feature a term loan of 400 million that matures seven years from the closing date a revolving facility of 60. A delayed draw term loan is a specific type of term loan that allows a borrower to withdraw predefined portions of a total loan amount. When a reporting entity enters into a delayed draw debt agreement it pays a commitment fee to the lender in exchange for access to capital over the contractual term.

Define Delayed Draw Term Loan Commitment Fee Rate. The Cost of Bespoke Finance. A fee paid by a borrower on the unused portion of its revolving credit loans or delayed-draw term loans to compensate the lenders for their commitment to make the funds.

Delayed draw term loans include a ticking fee a fee paid from the borrower to the lender. A commitment fee is a banking term used to describe a fee charged by a lender to a borrower to compensate the lender for its commitment to lend. A senior secured delayed-draw term loan credit facility the Delayed-Draw Term Loan Facility and the loans thereunder the Term Loans in an aggregate principal amount of.

Means a with respect to each Delayed Draw Term Loan Lender for the period from and including the Closing Date to but. The Borrower shall pay to the Administrative Agent for the account of each Delayed Draw Term Lender in accordance with its Pro Rata Share a. Delayed draw term loans include a ticking fee a fee paid from the borrower to the lenderThe fee amount accumulates on the portion.

Structuring Delayed Draw Term Loans Cle Webinar Strafford

Royal Philips Full 2021 Annual Report

Financing Fees What Are Financing Fees In M A

7 3 Classification Of Preferred Stock

Second Amendment Dated As Of April 1 2019 Among Nsm Insurance White Mountains Insurance Group Ltd Business Contracts Justia

Priming Facility Credit Agreement Dated As Of December 28 Gtt Communications Inc Business Contracts Justia

Types Of Corporate Loans Corporate Lending Explained

Financing Fees What Are Financing Fees In M A

Funding 101 Everything You Need To Know About Business Term Loans

:max_bytes(150000):strip_icc()/installment-loans-315559_FINAL-34e8393b3e624a31b96a285b270956bf.png)

What Is A Delayed Draw Term Loan Ddtl

7 3 Classification Of Preferred Stock

Commitment Fees Financial Edge

Evolent Health Inc 2019 Current Report 8 K

Smiledirectclub Inc 2022 Q2 Results Earnings Call Presentation Nasdaq Sdc Seeking Alpha

:max_bytes(150000):strip_icc()/shutterstock_197115044_mortgage_lender-5bfc317546e0fb00265d0275.jpg)

Delayed Draw Term Loan Definition

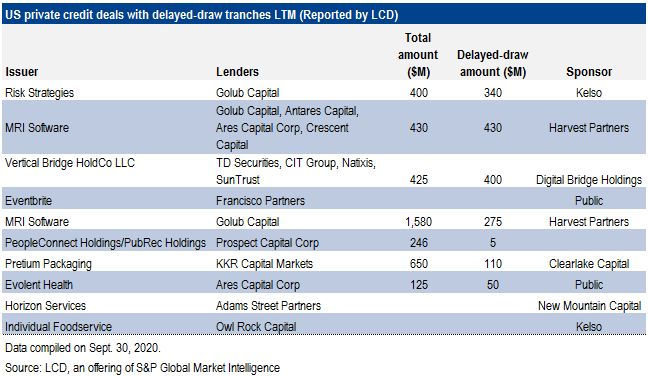

Pandemic Leads Lenders To Tighten Rules On Delayed Draw Term Loans S P Global Market Intelligence